Budget 2018 - What to expect

Friday, 06 October 2017

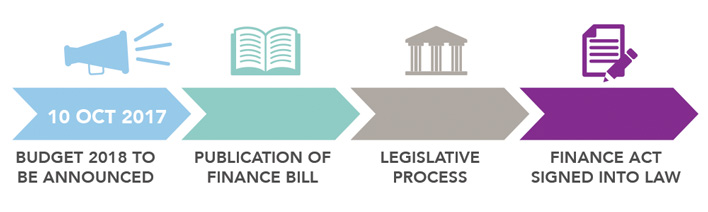

Budget 2018 will be announced on Tuesday, 10 October 2017.

Some measures that may be announced in Budget 2018 include:

Personal Taxes

- Cuts to the unpopular universal social charge

- Increase in standard income tax band to benefit middle income earners

- Increase in mortgage interest relief

Entrepreneur Taxes

- Increase in earned income tax credit

- Expansion of entrepreneur relief

Corporation Taxes

- Commitment to the 12.5% corporation tax rate

VAT

- Changes to VAT regime to help ‘Brexit-proof’ Irish businesses

- Increase in VAT rate for tourism and hospitality sector

Stamp Duty

- Increase in stamp duty applicable to the transfer of commercial property

Capital Taxes

- Increase in inheritance tax free thresholds to encourage the transfer of assets to younger generations

- Increase in the small gift exemption

Landlords

- Introduction of measures to incentivise renting of vacant properties

- Introduction of tax deduction for local property tax on rental properties

- No change to local property tax rates

Brexit

- Introduction of measures to ensure that Irish businesses are ‘Brexit-ready’

ByrneWallace will keep you informed of developments on Budget Day. Our dedicated Tax Team are ready to assist you and your business in navigating the changes proposed by Budget 2018.

Check our website for insights and analysis on the Budget from Tuesday 10 October.

Alternatively, please contact any member of our Tax Team or your usual ByrneWallace contact for more information and advice.