Commencement of Companies Act 2014 - Key Dates and Timelines for conversion, Financial reporting and related matters

Wednesday, 03 June 2015The Companies Act, 2014 entered into force on 1 June, ushering in the long-anticipated new Irish company law regime. Commencement of the Act triggered a number of key dates and timelines, relating to the requirement to convert all Irish private limited companies during the transition period, key dates for financial reporting and other relevant compliance matters, of which Irish companies and their directors, company secretaries and shareholders should be aware as outlined below.

Company Conversions, Name Changes and Other Changes – Key Timelines

- All existing Irish private companies limited by shares (EPCs) must convert either to the new model company type, the company limited by shares (LTD) or the alternative, a designated activity company (DAC) and prepare a new Act-compliant constitution in place of its memorandum and articles of association before 30 November 2016, although early conversion brings the benefit of legal certainty and, for LTDs, application of the new streamlined corporate governance provisions. Directors will need to undertake an analysis of the appropriate corporate structure for each EPC. Please click here for our guides to What is an LTD and when is conversion to LTD appropriate? and What is a DAC and when is conversion to DAC appropriate?

- All companies limited by guarantee (now CLGs) and unlimited companies (now ULCs) must change their names to include the CLG or ULC suffix during the 18 month transition period (so before 30 November 2016) unless eligible for an exemption from such name change.

- Please click here to read our Pre-Commencement Checklist - Preparing for a Smooth Transition.

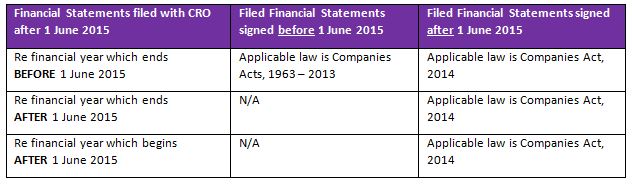

Financial Statements filed after 1 June 2015

The Companies Registration Office (CRO) recently clarified that it will take the following approach to audited financial statements delivered to CRO after 1 June 2015.

Deferred Commencement of certain other accounting and audit related changes

The Companies Act 2014 (Commencement) Order 2015 (SI 169/2015) published on 1 May 2015 (the Commencement Order) confirmed that the following new obligations in the Act will apply only in respect of financial years which commence after 1 June 2015:

- Obligation for certain companies to establish audit committees or explain why not

- Obligation to include a Directors’ Compliance Statement in the Directors’ Report

- Obligation to include a statement on Relevant Audit Information in the Directors’ Report

- Obligation to include gains on exercise of share options in Directors’ remuneration to include amounts paid to connected persons in Directors’ remuneration

- Obligation to include the names of all directors in the Directors’ Report

The Commencement Order also confirmed deferred commencement of a very limited number of other provisions. Please click here for further details: Companies Act 2014 - Commencement Order Published

Next Steps

ByrneWallace is happy to assist Irish businesses and their directors with the analysis and procedure for converting EPCs and generally in assessing the initial impact of the Act on their management, operation and compliance obligations. For advice or guidance, please contact one of our Corporate Partners.

Further Information

For further information on the Act, please click here for our Companies Act, 2014 – FAQs. Alternatively, please monitor our website or Follow Us on LinkedIn to read our other related publications such as the series of topical e-bulletins which are available on the ByrneWallace website and LinkedIn page and which we will continue to publish post-Commencement.