Companies Act 2014 – Conversion Deadlines & Other Key Dates and Actions for 2016

Monday, 15 February 2016Why is this relevant to my company?

The Companies Act, 2014 (“CA14”) entered into force on 1 June 2015, ushering in a new Irish company law regime. The deadlines for compliance with the requirement to convert Irish private limited companies to new company types and certain other obligations will occur during 2016. Irish companies need to be aware of these provisions so that they can take any actions required to achieve compliance.

Company Conversions & Name Changes – Key Actions and Deadlines 2016

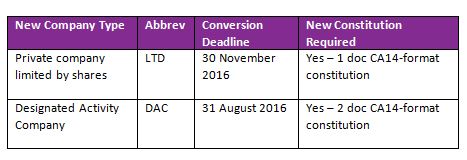

- All existing Irish private companies limited by shares, being the vast majority of Irish companies, must convert to one of two new company types below by the deadlines noted below:

- Early conversion has the benefit of legal certainty, especially if the company intends to carry out a corporate re-organisation, transaction, fundraising or bank financing in 2016. For LTDs, it also means early application of the new streamlined corporate governance provisions.

- Company directors need to decide if conversion to LTD or DAC is more appropriate in each case (and if more cost-effective to dissolve/wind up superfluous companies). Click here for our related guides on Converting to LTD and Converting to DAC.

- The suffix company limited by guarantee (CLG) or unlimited company (UC) will be automatically added by the Companies Registration Office (CRO) to the name of each such company with effect from 30 Nov 2016 (unless exempted) if the company has not changed it before then.

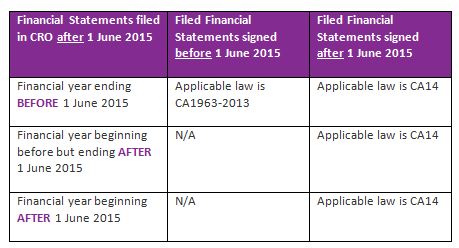

Does CA14 apply to my company’s FY15 Annual Financial Statements?

- CRO’s approach to the filing of audited financial statements delivered after 1 June 2015 is as below:

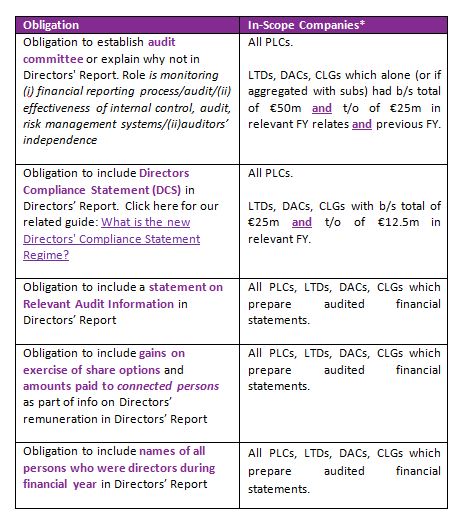

When are the changes to Directors’ Report introduced by CA14 triggered and what are they?

- The application of certain obligations which impact on the content of the Directors’ Report was deferred to apply only in respect of financial years commencing on or after 1 June 2015. In-scope companies which are subject to the new Directors' Compliance Statement or Audit Committee obligations will need to engage in advance planning during 2016.

*Subject to certain exceptions for companies which are credit institutions or insurance undertakings

Next Steps

Our dedicated team can assist Irish businesses and their directors in navigating the required analysis and procedure for converting companies to LTD or DAC, adopting new CA14 compliant constitutions, understanding the new Director' Compliance Statement regime and generally in assessing the impact of CA14 on their management, operation and compliance obligations.

For advice or guidance, please contact a member of the ByrneWallace Corporate or ByrneWallace Corporate Secretarial teams.

Further Information on CA14

For further information on CA14, please download our Companies Act, 2014 – FAQs. Alternatively, please monitor our website or Follow us on Linkedin to read our series of topical CA14 e-bulletins.