European Cross-Border Merger System

Thursday, 08 March 2018What is a cross-border merger?

A cross-border merger involves a merger between two or more European Economic Area (“EEA”) limited liability companies. At least two of the merging companies must be governed by the laws of different EEA states.

Irish cross-border merger statistics

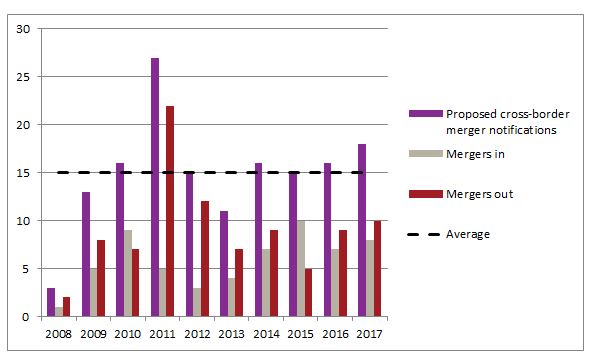

The cross-border merger system was introduced in Ireland in May 2008. Up until the end of last year, 150 proposed cross-border mergers involving Irish companies were notified to the Companies Registration Office (“CRO”). Fifty-nine of those involved mergers into Ireland, while 91 involved mergers out of Ireland. An average of 15 proposed cross-border mergers are notified to the CRO annually.

Annual Irish cross-border merger statistics are detailed in the graph below:

How does a cross-border merger work?

Each cross-border merger involves a company from one EEA state acquiring at least one company from another EEA state. Acquired companies are dissolved without going into liquidation, with the acquiring company taking on all the assets and liabilities of each acquired company. The terms of a cross-border merger are recorded on a document known as the common draft terms of merger which are approved by each merging company.

Certain procedures set down by legislation must be carefully followed by a merging company including advising shareholders and employees of how the merger will operate, filing the common draft terms with the local company registry, and making documentation available for inspection at the company’s registered office.

The process of completing a cross-border merger varies from jurisdiction to jurisdiction. The jurisdiction in which the acquiring company is registered drives the procedure. If a merger concerns an Irish acquiring company, an application must be made to the High Court to have the cross-border merger approved. The High Court will only approve the merger if it is satisfied that all pre-merger procedures have been complied with in each jurisdiction.

Types of cross-border merger

There are three types of cross-border merger which can be used depending on the circumstances, namely:

- Merger by absorption

A parent company acquires the assets and liabilities of its wholly-owned subsidiary company which is dissolved without going into liquidation. - Merger by acquisition

A company acquires the assets and liabilities of another company (or companies) which is (or are) dissolved without going into liquidation in exchange for the issue to the members of the acquired company (or companies) of shares in the acquiring company. - Merger by formation of a new company

A newly-formed company acquires the assets and liabilities of two or more other companies which are dissolved without going into liquidation in exchange for the issue to the members of the acquired companies of shares in the acquiring company.

Examples of cross-border merger uses

- Traditional merger involving unrelated companies.

- Group reorganisations (e.g. elimination of dormant companies within a group).

- Migration of business from one EEA state to another.

Advantages of cross-border mergers

There are a number of advantages of cross-border mergers, including:

Legal certainty

A cross-border merger cannot be declared null and void after it has been approved.

Cost savings

An acquired company is dissolved without going into liquidation which obviates the need to incur liquidation costs.

Less paperwork

Assets and liabilities are transferred by operation of law meaning that much of the documentation required to effect transfers in traditional sales, purchases or reconstructions is not required in the case of a cross-border merger.

Flexibility

The merging companies can generally select a date from which the transactions of an acquired company are to be treated for accounting purposes as being those of the acquiring company.

For further information on cross-border mergers, please contact any member of our Corporate team.