Finance Bill 2017

Thursday, 19 October 2017

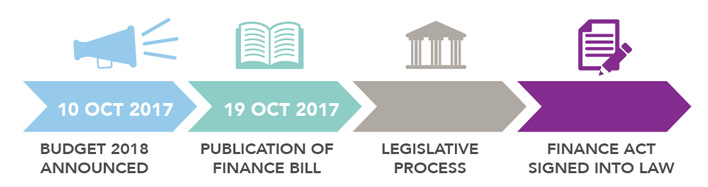

Today the Government published Finance Bill 2017 detailing the taxation measures announced by the Minister for Finance and Public Expenditure and Reform in his Budget speech last week. Click here to see the changes in tax rates and credits announced in the Budget in our Comparison Guide to Tax Rates and Credits.

The Finance Bill 2017 provides for the much anticipated changes to the Universal Social Charge (USC), increases in the personal income standard rate band and certain personal tax credits as well as details of the tapered extension to the mortgage interest relief.

The Finance Bill 2017 also introduces a share based remuneration scheme aimed at small and medium enterprises (SMEs) and provides in more detail the taxation measures affecting the property and construction sectors.

Introduction of New Relief: the Key Employee Engagement Programme

The introduction of the Key Employee Engagement Programme (KEEP) will create a share based remuneration incentive for qualifying employees of qualifying unquoted SMEs who are granted options at market value between 1 January 2018 – 31 December 2023 (subject to EU approval).

Gains realised on the exercise of a share option by qualifying employees of qualifying SMEs will not be subject to income tax, USC or PRSI but instead will be subject to Capital Gains Tax. The share options must be held for a minimum period of one year (subject to certain exceptions) and must be exercised within 10 years of grant to avail of this relief.

Stamp Duty Increased Rate on Non-Residential Property

The rate of stamp duty on the transfer of non-residential property has increased to 6% with effect from 11 October 2017.

However, a 2% rate of stamp duty will apply on the transfer of non-residential property where:

a) purchasers entered into a binding contract on or before 10 October 2017; and

b) the instrument of transfer is executed before 1 January 2018.

Stamp Duty Refund Scheme for Land Purchased for Development of Housing

A stamp duty refund scheme in relation to property purchased for the development of housing will be introduced by way of a Committee Stage amendment and therefore there are no details of the scheme in the Finance Bill 2017.

In his Budget speech last week, the Minister for Finance and Public Expenditure and Reform stated that the refund scheme would be subject to certain conditions, including a requirement that developers commence the relevant development within 30 months of the land purchase.

We will provide an update on the refund scheme once details become available.

Stamp Duty on Residential Leases

The threshold for which certain residential leases are chargeable to stamp duty will increase from €30,000 to €40,000.

Changes to the 7 Year Capital Gains Tax Relief

A relief from Capital Gains Tax (CGT) was introduced in the Finance Act 2012 for property (residential and commercial) purchased between 7 December 2011 – 31 December 2014. Subject to certain conditions, a gain arising on the disposal of the property would be fully exempt from CGT if the property is held for 7 years. Tapered relief would be available where the property is held for more than 7 years.

The requisite holding period will be reduced to 4 years for disposals on or after 1 January 2018 of those properties purchased between 7 December 2011 – 31 December 2014.

Pre-letting Expenditure relating to Vacant Properties

Subject to certain conditions, pre-letting expenses incurred on a residential property will be allowed as a deduction against rental income of that property.

The residential property:

a) must have been vacant for at least 12 months; and

b) is let between the date of the passing of the Finance Act 2017 (expected in late December 2017) and 31 December

2021;

The pre-letting expenses must:

a) have been incurred in the 12 months before the property is let as a residential premises; and

b) be of the same nature as those expenses generally deductible during a period of

letting;

The deduction:

a) will be capped at €5,000 per vacant residential property; and

b) will be subject to a claw-back if the property ceases to be let as residential property within 4 years of the first

letting.

The Finance Bill 2107 will now move forward for debate in the Dáil and Seanad.

ByrneWallace will keep you informed on developments as Finance Bill 2017 progresses into law.

To find out what the Finance Bill 2017 means for you and your business, please

contact any member of our Tax Team or your usual ByrneWallace contact.