“No Deal” Brexit – VAT update

Friday, 08 February 2019The Minister for Finance Paschal Donohue has announced that the Irish Government intends to implement a temporary measure allowing for the postponed accounting for VAT on imports from the UK in the event of a “No Deal” Brexit.

Under the temporary measure, businesses would no longer pay VAT at importation but account for any VAT due through their VAT return (e.g. goods imported on 5th May, no VAT paid on importation, VAT accounted for through the May/June VAT return which is due for submission on or by 23 July).

This is a very welcomed development which will result in significant cash flow savings for Irish businesses and we would urge the Government/the Revenue Commissioners to make this a permanent measure, where possible, in the event of a “No Deal” Brexit.

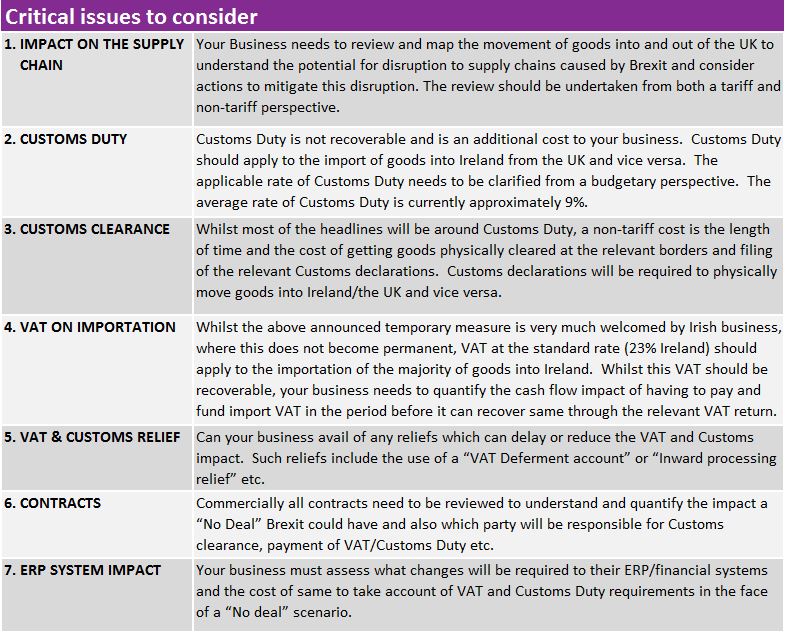

At ByrneWallace we have been assisting clients to navigate through the potential legal, regulatory and tax issues which may result from a “No Deal” Brexit. With regard to VAT and Customs, some of the critical issues which businesses need to consider include the following:

If you would like to discuss the VAT and Customs implications of a “No Deal” Brexit for your business or any other Brexit related matters, please contact a member of our Tax Team or your usual ByrneWallace contact.

To register for ByrneWallace updates click here, and follow us on LinkedIn.