Corporate Sustainability Due Diligence Directive

Tuesday, 26 March 2024

On 15 March 2024, EU Member States approved a modified version of the Corporate Sustainability Due Diligence Directive (CSDDD). The CSDDD will have significant impact on many EU companies and non-EU companies active in the EU, as well as on their value chains throughout the world. It shall require in-scope companies to perform due diligence to identify environmental and social areas of impact, to prevent, mitigate and account for ‘actual and potential’ human rights violations and environmental risks throughout their supply chains, including both their operations as well as upstream and downstream activities, such as distribution and recycling. It is anticipated that the directive will establish grievance mechanisms and a requirement to publically report on violations, so it will be imperative that in-scope companies adopt a transition plan for climate change mitigation.

The CSDDD also proposes a civil liability regime for victims harmed by non-compliant companies and implications for directors duties’ to be enforced through Member State laws.

Following extensive negotiations, the CSDDD has been significantly scaled back in scope. This reduced the number of companies subject to the CSDDD, lowered thresholds for high-risk companies (which may be reintroduced again in the future) and the staggered application of the legislation.

The CSDDD complements the Corporate Sustainability Reporting Directive (CSRD) by adding a substantive due diligence requirement and aligns with the CSRD mandate for a business model change required to transition to a sustainable economy (limiting global warming to 1.5 degrees Celsius in line with the Paris Agreement). It also aims to harmonise country specific legislation (e.g. in France, Germany, Switzerland, Belgium, Netherlands, and Norway) across the Member States.

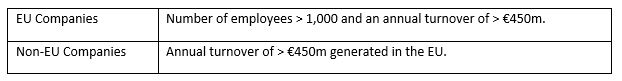

It is understood that the CSDDD will apply to the following companies:

The CSDDD sets out the due diligence process defined by the OECD Due Diligence Guidance for Responsible Business Conduct, and in-scope companies should ensure that:

1. Due diligence processes are integrated into policies and management systems;

2. Adverse human rights and environmental impacts are identified and assessed;

3. Actual and potential adverse human rights and environmental impacts are prevented, ceased or minimised;

4. The effectiveness of measures are monitored and assessed;

5. Communicate how impacts are addressed; and

6. Provide for or cooperate in remediation when appropriate.

Non-compliance may result in fines and compliance orders with monitoring by national supervisory authorities.

The next step will be a final vote of all MEPs in Strasbourg on 24 April 2024, and if passed it is expected to be transposed into domestic law by Member States by 2026, with reporting for large companies potentially commencing 2027.

For further information, please contact Karen Outram, Mark Kavanagh or Paraic O'Kennedy from the Banking and Finance team.